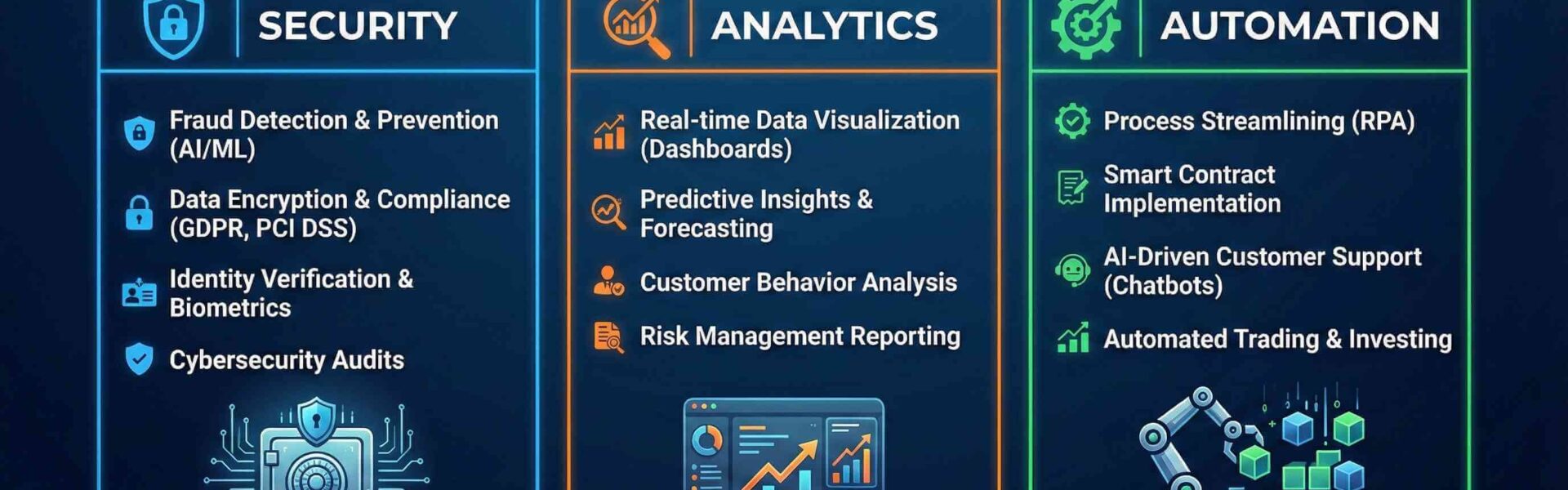

Comparing Key Fintech Software Development Services: Security, Analytics, and Automation

Introduction

As financial technology continues to transform global markets, businesses increasingly rely on fintech software development, advanced digital platforms, and custom-built financial solutions to stay competitive. Understanding the differences between major fintech software development services, especially security, analytics, and automation, is essential for any organization looking to innovate. Whether you are exploring options for partnering with a fintech software development company, planning the creation of a new digital product, or simply asking, “What is fintech software development?”, this guide provides a clear and structured comparison.

What Is Fintech Software Development?

Fintech software development refers to the process of designing, building, and maintaining digital tools that enhance financial operations—such as payments, lending, trading, insurance, personal finance, compliance, and banking. These solutions may be custom-built by a specialized fintech software development company or developed internally by financial institutions.

Modern custom fintech software development typically includes a wide range of services, but security, analytics, and automation stand out as the pillars of innovation. Below, we compare these core components and their role in building effective financial products.

1. Security Services: The Foundation of Trust

Security is the most critical element of any digital finance product. As financial institutions handle sensitive data and high-value transactions, robust protection is not optional—it is mandatory.

Key Features of Security-Focused Fintech Software Development Services

- End-to-end data encryption

- Multi-factor authentication (MFA) and biometrics

- Fraud detection tools powered by AI

- Regulatory compliance features (KYC, AML, PCI DSS)

- Real-time monitoring and anomaly detection

Why Security Matters

- Reduces the risk of financial fraud

- Protects user identity and sensitive data

- Helps companies meet regulatory requirements

- Strengthens customer trust and product reliability

A professional fintech software development company typically places security at the center of the product lifecycle, ensuring that every layer of the system is resistant to cyber threats. When choosing fintech software development services, organizations should prioritize a provider capable of delivering strong cybersecurity frameworks.

2. Analytics Services: Turning Financial Data into Business Value

Analytics has become a major differentiator in the fintech sector. Modern solutions collect and process massive amounts of data—from transaction patterns to credit risk scores—and convert it into insights that drive decision-making.

Key Capabilities in Analytics-Focused Fintech Development

- Predictive analytics for credit scoring, loan approval, or risk assessment

- Customer behavior analysis for better user engagement

- Real-time reporting dashboards

- Algorithmic trading systems

- Revenue optimization and forecasting tools

Why Analytics Is Essential

- Helps businesses personalize financial experiences

- Enables smarter, faster decision-making

- Improves operational transparency and reporting

- Supports investment and lending intelligence

With custom fintech software development, analytics solutions can be tailored to the needs of banks, fintech startups, and financial enterprises, ensuring more accurate insights and better business outcomes.

3. Automation Services: Accelerating Financial Operations

Automation is transforming the financial industry by eliminating manual processes and reducing operational costs. As part of modern fintech software development, automation integrates advanced algorithms, AI, and machine learning to handle repetitive tasks with speed and accuracy.

Key Automation Features

- Automated payment processing

- Smart contract execution using blockchain

- AI-powered chatbots and customer support tools

- Automated compliance and reporting

- Workflow automation for loan approvals, underwriting, and auditing

Benefits of Automation

- Lower operational costs

- Higher accuracy and fewer human errors

- Faster service delivery and improved customer experience

- Scalable operations for growing fintech products

A strong fintech software development company will design automation processes that seamlessly integrate with existing systems while supporting long-term scalability.

Conclusion: Choosing the Right Fintech Software Development Services

Security, analytics, and automation each play a vital role in shaping the future of digital finance. Together, they create resilient, data-driven, and efficient financial systems. Selecting the right fintech software development services—and understanding how they align with your business needs—is key to building a successful fintech product.

Organizations looking for deeper customization can benefit from custom fintech software development, ensuring solutions are built exactly for their workflows and regulatory environments.

Whether you are launching a new financial application or enhancing an existing platform, knowing what fintech software development is and how its core services differ will help you make informed, strategic decisions that accelerate innovation.