Introduction

Mobile banking apps aren’t new. What is shifting, though, are user expectations. People now expect more than remote check deposits and bank‑statements: they want transparency, flexibility, integration of digital assets, global reach, and security built in rather than bolted on. The blackcat app provides a strong case study of how one fintech is aiming to deliver on those expectations. Let’s take a deeper look.

What the blackcat App Does Differently Unified Account Management

Many fintech apps offer either banking (fiat) or crypto, or you have to use separate apps. The blackcat app combines:

- A European IBAN account you can use for standard banking tasks (receiving money, paying bills, SEPA transfers)

- A crypto wallet that lets users hold, send, receive, and convert digital assets (BTC, ETH, USDT, USDC) within the same app

This reduces friction: no need to bounce between apps, no need to export/import your crypto or manually track conversions outside of one interface.

Cards & Payment Controls

Another strong piece of blackcat is its card‑management tools:

- You get a virtual card immediately, with option for a physical card

- Ability to freeze/unfreeze the card from the app — useful if it’s lost or compromised

- Ability to set spending limits or separate cards for different purposes (budgeting, family, etc.)

These tools give the user more real‑time control over spending and protection, which is increasingly expected from modern digital wallets and bank apps.

Fee Transparency & Free‑Tier Access

Something that often annoys users is “hidden” or unexpected costs. With blackcat:

- The base tier is free (no monthly subscription)

- Many of the standard banking operations (e.g. some SEPA transfers, IBAN maintenance) are included without cost under the free plan

- All charges, conditions for card delivery, address verification, or apply in certain countries, are disclosed in the app store description and within the app itself.

This kind of full disclosure helps users anticipate true cost, reduces insecurity about surprise fees, and builds trust.

Crypto + Fiat Flows

Crypto features are no longer niche. For many people, they want a mix: part savings, part investment, part spending. The blackcat app allows:

- Buying crypto with euro

- Converting crypto back to euro when needed

- Moving between crypto wallet and IBAN or card for spending

This makes crypto more usable in everyday life, not just something you hold separately hoping it rises in value.

UX & Onboarding: Where First Impressions Count

A lot of what makes or breaks an app is the first 10 minutes: registration, verification, setting up your card, exploring the interfaces. Blackcat’s design shows awareness of this:

- The onboarding flow asks for identity verification (selfie + ID scan) plus address proof in certain cases. Those steps are made clear.

- The interface indicates the availability of virtual card immediately, so users can begin using it even before the physical card arrives.

- Card features (freeze, limits, transaction history) are accessible in the app without digging through menus.

These kinds of design choices reduce friction, reduce user drop‑off, and increase trust.

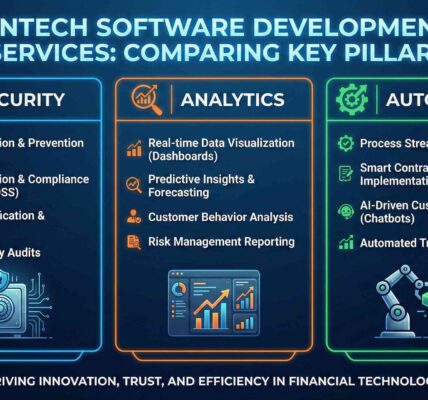

Why Security & Compliance Behind the App Matter

With money (fiat and crypto) handled in one place, users need strong guardrails. Key areas:

- Data protection is clearly flagged: the app follows regulations (GDPR, etc.)

- Card security is enabled by standard tools (e.g. 3D Secure for online card payments)

- Identity verification helps comply with anti‑money laundering (AML) rules, which also protects users in case of fraud or misuse

When you combine financial operations with digital assets, the risk surface increases; an app that does not bake in security and regulation will likely lose user trust quickly.

Potential Trade‑Offs & What to Watch

Even well‑designed apps have trade‑offs. With the blackcat app, some aspects users might want to keep in mind:

- Verification delays or complexity: depending on country or document type, proving address or identity may take longer.

- Geographic limitations: While many services are global, some card delivery, SEPA availability, or specific regulatory features may depend on where you live.

- Crypto volatility & costs: Converting currency or crypto involves rates, fees, and market spreads. Users who convert often need to keep an eye on them.

- Support responsiveness in real cases: the promise of 24/7 support is strong, but actual experience (response time, resolution) is what matters most to users.

How blackcat App Reflects Broader Trends

Looking beyond the app itself, its features mirror several broader shifts in finance:

- Hybrid financial tools: Users expect both fiat and crypto, payment cards, global transfers, savings — all in one place.

- Control & autonomy: Tools that allow users to freeze cards, set limits, track real‑time spend, control wallet conversion give empowerment.

- Transparent pricing: As competition in fintech intensifies, hidden fees become major differentiators. Being upfront matters.

- Mobile‑first, user‑centric design: With so many users managing money via phones, the UI/UX becomes crucial — clarity, speed, ease of access.

Final Reflections

The blackcat app isn’t simply another fintech app. It is illustrative of what many users want now: an integrated platform that doesn’t force you to separate “banking” from “crypto,” that makes money tools accessible globally, and that builds trust through usability and transparency.

If you’re exploring how to simplify your financial life — handling different currencies, needing global transfers, wanting crypto alongside your everyday spending — apps like blackcat show a viable path. As with all financial tools, what ultimately matters is your own needs: where you live, what currencies you handle, how much you use crypto, and how sensitive you are to fees or delays.